Is frequent nighttime urination doing

a number on you?

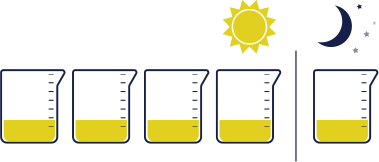

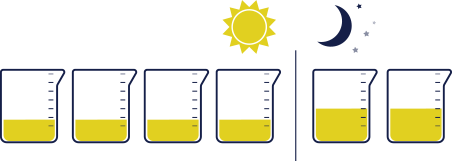

Waking up at night to urinate is a condition called nocturia. But as your Wake Number (the number of times you wake at night to urinate) increases, so does the impact. The good news is that you don’t have to suffer in silence. Nocturia is treatable, and you can do something about it.

That’s why keeping track of your Wake Number is so important.

Take the Wake Number Quiz